Questions to Ask a Mortgage Lender

understanding the process

Before starting your search, assess your financial situation and determine what kind of mortgage you can afford. Consider your income, credit score, debt-to-income ratio, and how much you can afford for a down payment. These factors will influence the type of loan you qualify for and which lenders are willing to work with you.

Once you've narrowed down potential lenders, compare their loan offers. Look at their interest rates, terms (15-year vs 30-year), fees involved, and whether they offer fixed-rate or adjustable-rate mortgages.

Check online reviews, ask for references, and consult with real estate professionals to learn about a lender's reputation. A trustworthy lender will have a strong track record of satisfied customers and ethical lending practices.

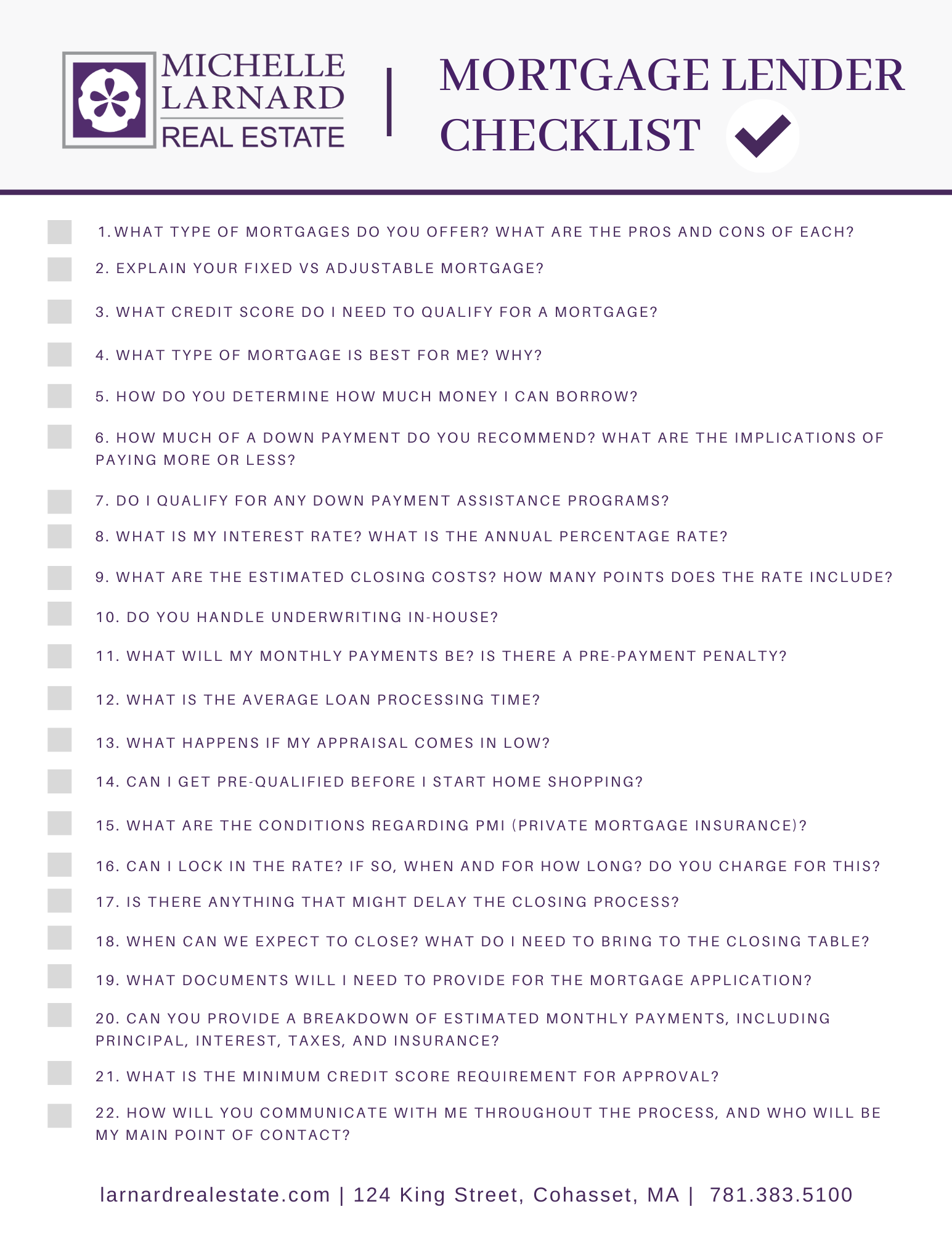

ASK THE RIGHT QUESTIONS

When you meet with potential lenders, come prepared with questions. Ask about their loan approval process, what documents you'll need, how long it will take, and if there are any prepayment penalties. Click here to download the below questions.