Conversion in progress ...

Please wait while we generate your PDF

First Time Home Buyers Guide

Getting Started

Buying your first home is exciting! In many cases, it can be one of the biggest financial decisions you can make. It can also be overwhelming for first time home buyers. This first time home buyers guide will cover the basics of the process. Then, when you are ready, begin by choosing a real estate professional who will guide you smoothly through the process.

Some questions to consider as you begin.

shop around

Find the right mortgage broker for your particular needs. Shop around. Compare rates. Compare companies. Ask questions such as: the difference between fixed and adjustable rates, what credit score they require, and the loan interest rate.

Prepare your finances

Underwriters are like detectives. Their job is to make sure you are who you present yourself to be. To keep the process moving, make sure your finances are in order and you have gathered the appropriate paperwork required for the loan.

Pay attention to finances throughout the process

As you move through the process, understand specific details which can affect your mortgage outcome. Changes in marital status, job status, and bank accounts may impact the loan outcome.

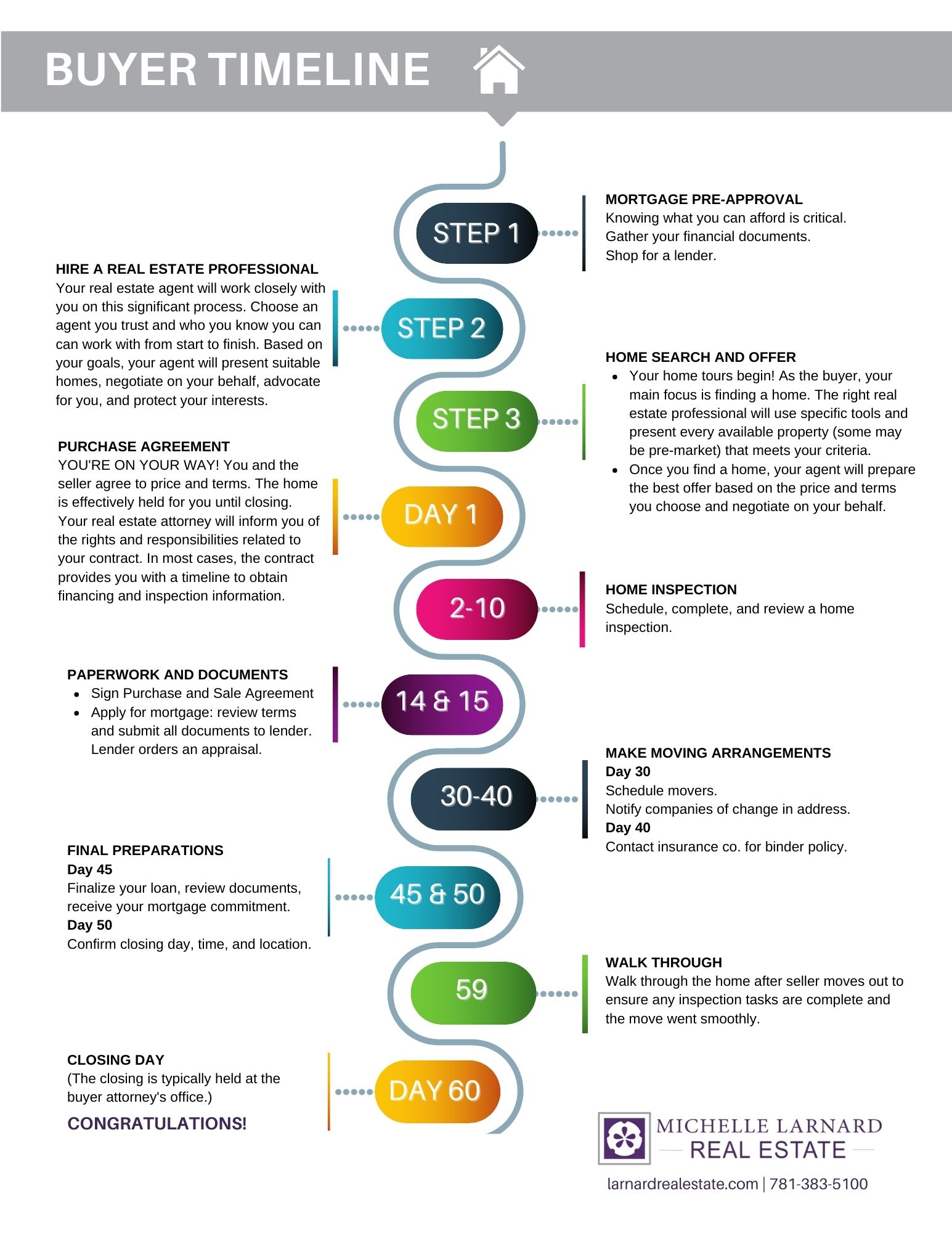

Buying a Home Timeline

This step by step chart will help explain the timeline for the buying process.

Mortgage Strategy

Be prepared for every stage of the process. This is especially true when it comes to choosing a mortgage lender and applying for a loan. The mortgage process is one area which can derail the home transaction if not handled properly.

shop around

Find the right mortgage broker for your particular needs. Shop around. Compare rates. Compare companies. Ask questions such as: the difference between fixed and adjustable rates, what credit score they require, and the loan interest rate.

Prepare your finances

Underwriters are like detectives. Their job is to make sure you are who you present yourself to be. To keep the process moving, make sure your finances are in order and you have gathered the appropriate paperwork required for the loan.

Pay attention to finances throughout the process

As you move through the process, understand specific details which can affect your mortgage outcome. Changes in marital status, job status, and bank accounts may impact the loan outcome.

Reasons to hire a real estate professional

Hiring a local real estate agent is by far the best first step to take when you are buying your first home. They will:

Your real estate professional will help you define your wish list and goals.

Provide mortgage application advice.

Guide you through the entire process for a smooth and stress-free transaction. Provide a timeline, details about information needed, and negotiations.

Create individualized property search. Send you listing updates.

Negotiate a purchase offer.

Once you have closed on your home, your real estate agent will provide support, resources, and offer names of local vendors for you to contact.